Why A Private Equity Firm Backed by Bernard Arnault Is Putting $400 Million Into Norwegian Cruise Line

June 4, 2020

Has COVID-19 delivered a death blow to the cruise industry? The luxury brand buyout specialists at L Catterton think not.

As shares of Norwegian Cruise Line continued to sink like the Titanic—down 80% from the end of 2019 to $12 per share by late April—Scott Dahnke and his team at L Catterton were quietly eyeing the wreckage. The partners at his Greenwich, Connecticut, private equity firm had already made a killing by taking a cruise ship-based beauty chain public and they were focused on high-end brands. After all, the “L” in their name comes from their financial backing by LVMH, the French luxury goods giant and they had already scored a string of successes from investments in the upscale home decorator Restoration Hardware, Lily’s Kitchen, a London-based organic dog food maker and Peloton, the Internet-connected stationary bicycle concern. But this was new territory. Never before had they seen such a rapid reversal of fortune of a well-regarded brand. Dahnke decided the time was right to pounce, despite the fact that in a best-case scenario, Norwegian wouldn't be expected to sail any of its fleet’s cruise ships for at least two months.

“There’s no question that consumers love to cruise . . . they want to get back on the water,” says the 54-year-old Dahnke. “We’re backing a strong and well-positioned company in a resilient industry.” The cruise industry has been especially hard-hit by coronavirus. Not only is the entire travel industry paralyzed, cruise ships were the sites of some of the first significant outbreaks outside of China. Norwegian, with 2.7 million customers per year, ranks third among the big cruise operators, behind Carnival and Royal Caribbean Cruises. All have seen their stocks plummet more than 70%.

Carnival recently announced that it would resume its North American cruises on August 1, 2020, gambling that consumers will go on cruises before a vaccine is developed. Norwegian is being even more aggressive, but its 28 ships won’t sail again until at least July 1, 2020.

Norwegian might feel it doesn’t have much of a choice but to get back out to sea. Things have gotten so bad at the Bermuda-based cruise line that in a filing with the Securities and Exchange Commission in early May, it warned investors of potential bankruptcy, saying there was “substantial doubt” about its ability to keep operating amid coronavirus lockdowns. That same day, L Catterton surfaced with a $400 million investment, through a private placement of six-year convertible senior notes. It was a move reminiscent of Warren Buffett’s lifeline to Goldman Sachs in 2008, because the notes, which will ultimately make L Catterton the cruise line’s largest shareholder, pay 7% interest.

L Catterton’s cash infusion came with the stipulation that Norwegian would raise at least another $1 billion from the other stock and debt offerings. It did: A day after its bankruptcy warning and L Catterton’s investment, Norwegian announced that it had raised another $2 billion, selling $460 million worth of common stock and $1.54 billion in two debt offerings.

Damn The Pandemic, Full Speed Ahead

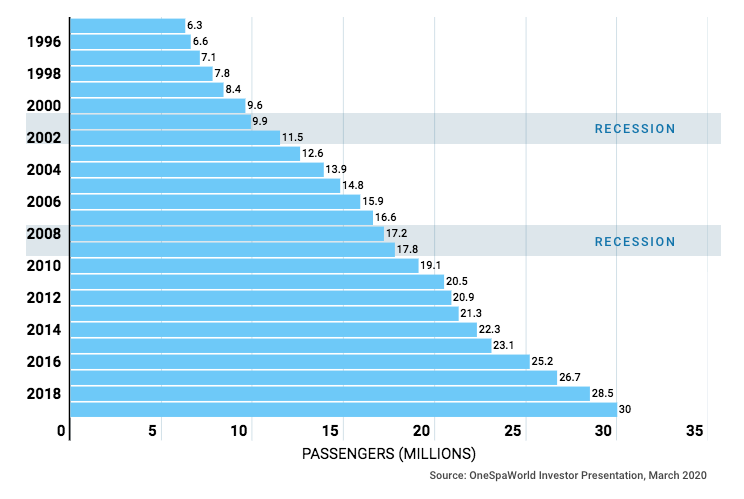

Despite two recessions over the last 25 years the cruise business has shown unabated growth in passengers globally. The invisible virus may be its most formidable challenge.

That investment helped L Catterton’s partners understand the economics of cruise ships: Passengers are loyal, older and wealthy, and the business largely recession-proof. According to OneSpaWorld’s research, worldwide passenger growth on ships has compounded at a rate of 6.7% per annum for the past 25 years, through the broader economy’s up and downs. A typical cruise passenger is 49 years old, married, with an average household income of $114,000, and cruises on every 2.3 years. And they aren’t shy about treating themselves. OneSpaWorld’s customers typically spend about $238 on wellness treatments ranging from aroma seaweed massages to Botox injections.

“The data is as compelling as anything as I’ve seen in my career. . . . There is a high degree of loyalty, repeat cruises,” says Dahnke. “OneSpaWorld was our first investment directly in the cruise industry and it has helped inform our views.”

L Catterton took OneSpaWorld public in March 2019 in a deal worth $850 million, while still retaining nearly half their original stake. The stock ran up 37% from its IPO until January 2020; It’s now down 50%. In 2019, the company recorded $562 million in revenue, and while it will take a hit in 2020, revenues are expected to rise to $654 million in 2021. L Catterton, which still owns 14% of OneSpaWorld, just injected another $75 million in the wellness operator, providing liquidity for the next two years.

L Catterton, which was formed in 1989, was originally known as Catterton Simon Partners because one of its founders was William E. Simon, an investment banker and Treasury Secretary under Presidents Nixon and Ford. In the early 1980s, Simon stunned Wall Street with the leveraged buyout and subsequent public offering 18 months later of Gibson Greeting Card Co., turning an $80 million investment into roughly $300 million and personally making over $70 million on a mere $330,000 invested. The deal sparked the LBO boom of that decade.

In 2016 Catteron partnered with LVMH’s private equity arm, L Capital. The partners at L Catterton, including J. Michael Chu and Scott A. Dahnke, own 60% of the firm, while luxury goods maker LVMH and its owner Bernard Arnault control the rest. Arnault is the world’s third-richest person, worth $91.8 billion.

Dahnke, who got his mechanical engineering degree from Notre Dame and an M.B.A. from Harvard, joined the firm in 2003. Before joining Catterton he worked in private equity at Deutsche Bank and was a partner at McKinsey, the top-tier consultancy firm. His co-CEO, J. Michael Chu, 61, is an original founder of the firm, who spent his early career as a banker in Hong Kong.

Today, L Catterton has over $20 billion in capital, which it invests in leading consumer brands, from fitness providers Equinox and ClassPass to companies like Cholula hot sauce and the Honest Co., Jessica Alba’s eco-friendly maker of high-end diapers, makeup and kitchen cleansers.

L Catterton’s bold bet on the cruise company is not without serious risk. Norwegian had roughly $6.5 billion in net debt as of December 31, 2019. Today that figure has climbed to more than $7 billion and its latest round of debt carries interest rates of over 12%. According to Harini Chundu, vice president and analyst at Advent Capital Management, much of the debt consists of mortgages on its ships as well as two resort islands Norwegian owns in the Caribbean. “There’s a lot of secured debt, which we expect to increase.”

Dahnke insists that Norwegian is the best-positioned out of all of the major cruise lines. On top of an “exceptional management team,” it has the youngest and smallest fleet, which translates into a more nimble fleet deployment, higher margins and more revenue per passenger, according to Dahnke.

Obviously, some things will change once lockdowns are lifted, but it won’t be business as usual for the industry. Robert Kwortnik, who teaches marketing at Cornell’s College of Business, says cruise operators will need to beef up costly health and safety protocols. “Looking ahead, the number one thing cruise lines are going to have to do is create ironclad reassurances around health and safety.”

Also squeezing margins: the likelihood that ships will be carrying fewer passengers. But Dahnke argues that Norwegian doesn’t need to get anywhere near historical levels of occupancy to break even on a voyage. Operating costs are lower because fuel costs, one of the largest line items, are down, he says.

The pandemic will certainly put Norwegian’s business model to the test. Still, if history is any guide, the Sept. 11 terrorist attacks, which initially halted nearly all travel spending, ultimately had little effect on leisure travel. In fact, according to Kwortnik, airlines and cruise ships were operating at nearly full capacity within a year. If that is the case this time around, it will mean smooth sailing for Scott Dahnke and the partners of L Catterton.

View the original article here